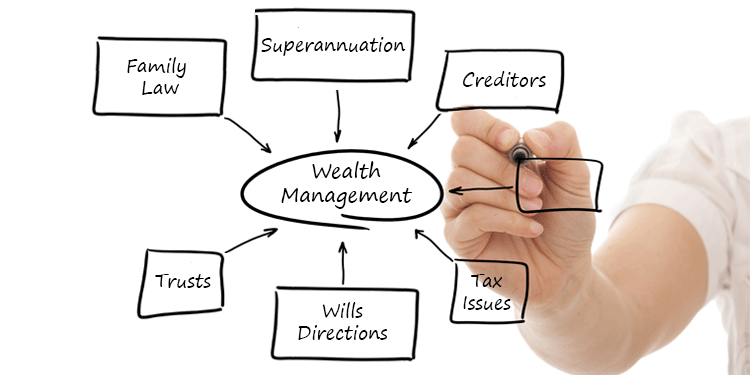

Wealth management structuring involves considering not only the wealth a client has built up but also how they intend to use and to pass on that wealth. Different structures can be used to ensure that each client’s wealth is managed in a commercial and tax effective manner and that it is passed as the client intends to his or her chosen beneficiaries.