Julie Van der Velde

B.Sc. Business Administration (Hons); LLB (Hons); GDLP; MTAX; FTIA; FCPA; CTA; TEP

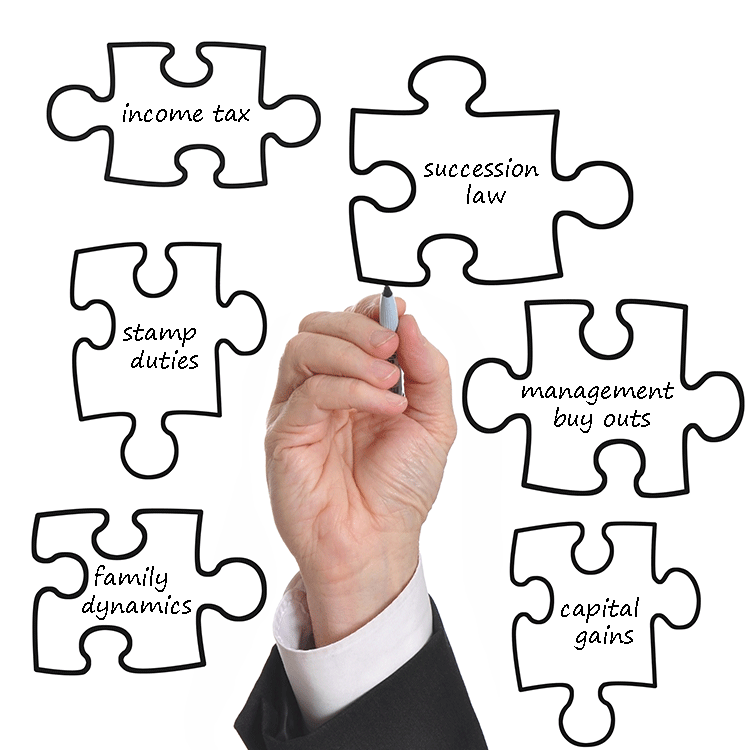

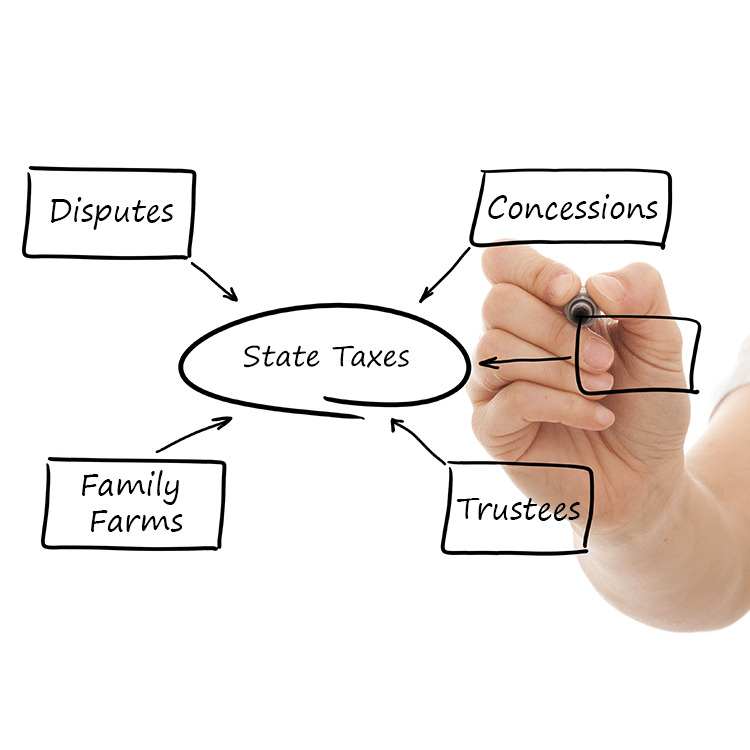

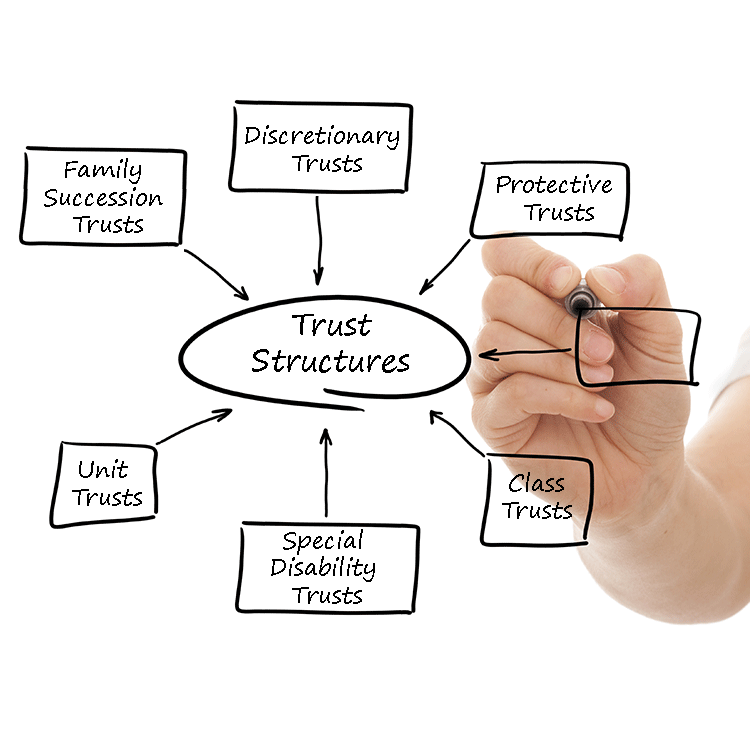

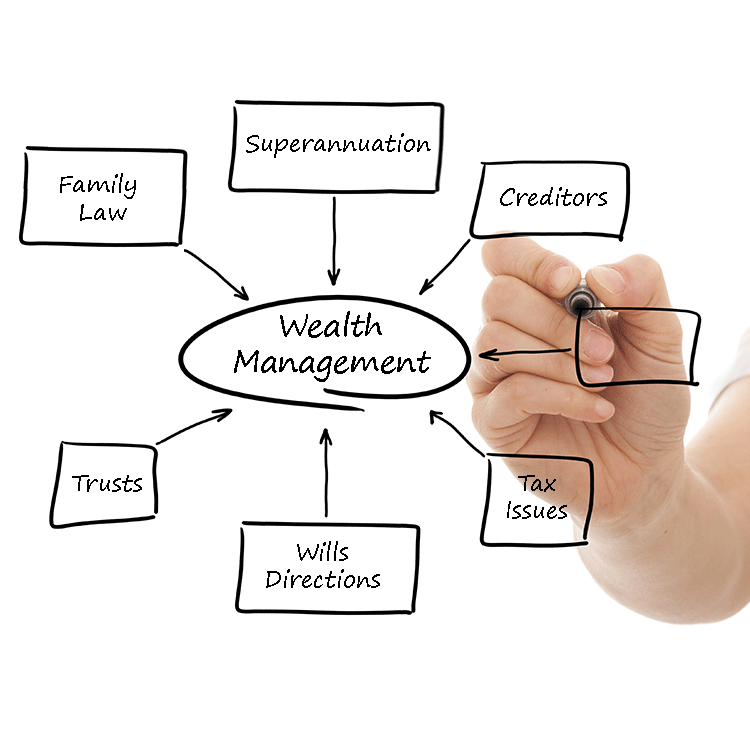

Julie Van der Velde is the founder and principal of VdV Legal. She works with businesses and their advisors to help ensure practical commercial outcomes. Julie has a particular interest and significant expertise in taxation and revenue law, intergenerational transfer, business succession, estate planning and superannuation. She has experience across a range of sectors including professional and financial service firms, property sale and development, information technology, not for profit entities and primary production.

Prior to establishing VdV Legal Julie worked with a range of accounting and legal practices including several years as an Associate Director with an international accounting firm where she was involved in drafting submissions to Treasury on various matters including the modifications to the anti-avoidance provisions of the Income Tax Assessment Act 1936 and proposals for the reform of the taxation of trust structures. This experience demonstrates Julie’s high level of technical knowledge which she combines with commercial acumen. Julie understands commercial operations and family business and the importance of providing clear and commercially useful opinions and advices.

Julie is a founder member of the Society of Trust and Estate Practitioners in South Australia and served on the committee for over ten years from its inception in February 2010 to May 2020. She also served as a co Chair of the Branch.

A Chartered Tax Adviser, a Fellow of the Tax Institute, a Fellow of CPA Australia and a registered Trust and Estate Practitioner; Julie is a regular presenter on taxation and commercial matters for many professional bodies throughout South Australia. She is a recommended Wills and Estate Planning Lawyer in Doyles Guide each year for 2017 to 2020 and winner of the prestigious Taxation Institute Chartered SME Tax Adviser of the Year in 2017.

Julie is admitted to the Supreme Court of South Australia, and to the High Court of Australia.

View Julie’s full profile on